Chapter 9Impact reporting in the 2020s

How do smart companies navigate the impact reporting jungle?

Sustainability reports, certificates, disclosure commitments, consultants selling various projects? As a company, today's impact reporting is not easy to get right. Upright believes in less anecdotes and more facts - which respect your stakeholders and help them find the data they need.

Here's five simple guidelines for reporting your impact!

Guideline 1. Be refreshingly honest about your negatives

In today’s impact discourse, underestimating your audience’s capability to check facts almost always backfires.

The era of greenwashing slogans is simply over. They only get you butchered in social media. Instead, try being frank and transparent about the negative impacts you have.

For example, start by stating: “Our company’s main cost for the environment is our energy usage. Internally, we use annually X MWh of electricity produced with a mix of coal and wind. In addition to that, our logistics partners use Z and Y. However, we believe that energy usage is justified as with it, we create 6,500,000 vaccines for measles every year.”

Guideline 2. Don’t just explain how you have minimized your minuses, communicate your pluses too

Another pitfall in impact reporting and communications today is talking only about making negative things smaller by making relative improvements. “We have reduced our travel miles by 7 %.”

This doesn’t fly anymore: you have to be able to argue why you travel in the first place and what good comes from it. Explain the big picture of what kinds of negative impacts you cause and how they lead you to being able to produce the positive values - due to which you exist in the first place.

Guideline 3. Set your performance in context

Help your audience understand what is good and what is not. Just saying your emissions were X tons last year hardly helps anyone. Show your performance compared to others.

Guideline 4. Communicate your value chain impacts

Don't just talk about impacts that happen inside your company. Your impact is so much more than that. Be brave to show how your supply chain looks like - and most importantly, impacts that happen once your product or service is being used by your clients. These downstream impacts are often the most significant in size and the least understood.

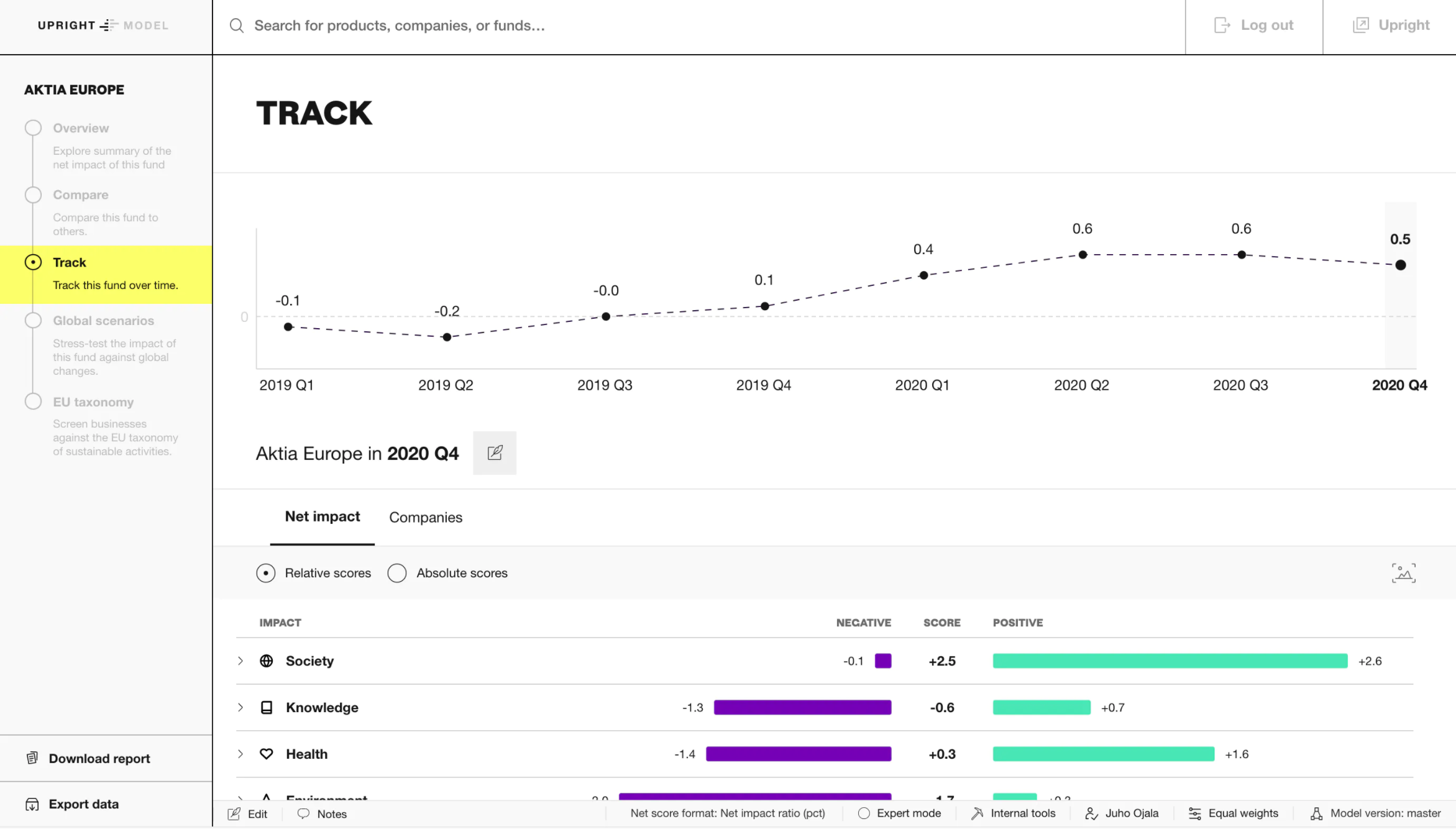

Guideline 5. Show development in time

Share how your net impact is constantly developing and link it to your strategy. Show milestones like new business launches which positively impacted your holistic value creation. Translate your future strategies and impact targets to your net impact to show how you will improve in the coming years.

How do smart investors report on their impact?

Investors face many of the same struggles as companies, too. ESG reports and other compliance-focused data may easily disappoint your client who wants to understand how your funds really impact the world. Sure, this and this many standards where taken into account, but what do the fund's companies really get done? What is their aggregate impact on the surrounding world?

The same five simple reporting guidelines for companies apply for asset managers and owners, too. Additionally, investors should remember to track and report both the net impact of their individuals funds, as well as their own holistic impact as an investor organization over time. It is not just about what you hold in your portfolio right now, but also about how you use your power to improve your investments over time.