Chapter 4Best funded startups

What is VC money really getting done?

Startups have a nice reputation when it comes to impact. They solve big problems and innovate, teach young people new things and can make lots of money. They rarely have heavy physical production and thus no significant emissions.

But does that reputation need a reality check?

We analysed how the best funded growth companies in Europe and in the US perform in terms of net impact. The results reveal that while some startups really do focus on solving the biggest challenges of our time, most of them don’t.

Why is the majority of VC money flowing towards relatively low-ambition projects impact-wise?

The majority of the analysed growth companies (19/30 in Europe and 11/30 in the US) are primarily focused on simply making consumers’ lives easier: creating convenient and more affordable solutions for transportation and travelling, making e-commerce and payments run smoother, and delivering food to customers’ doorsteps. While these services can bring temporary and marginal increases in joy to customers’ lives, it is clear that they are a far cry from solving the most critical problems of our time.

Despite all the stereotypes of “world-saving startups”, only a handful of the best funded growth companies are actively providing solutions to environmental problems. In Europe, Lilium (Figure 4.2) contributes to air transport electrification with its electric airplanes, and Rivian (Figure 4.3) focuses on finding solutions to energy storage problems. In the US, growth companies NURO, Rivian and Faraday Future contribute to electric low-carbon road transport. Through providing their technology to electric vehicle manufacturers, autonomous driving companies such as Waymo, Cruise and Argo AI also have an indirect effect on transport electrification.

While the best funded transportation startups in the US dabble with electric and self-driving cars, in Europe the focus is on used vehicles and sharing: several companies operating in the transportation sector rely on the principles of the sharing economy.

Even though sharing-based business models have a lot of potential from a circular economy point of view, their net impact profiles show that they are not automatically positive for the environment. Even though sharing increases the utilization rate of resources, transportation still uses energy and creates emissions. An example of this can be seen in BlaBlaCar’s net impact profile in Figure 4.4. Depending on what activities the transport services replace - e.g. driving with privately owned passenger cars or cycling - net impact in terms of environment can be either positive or negative.

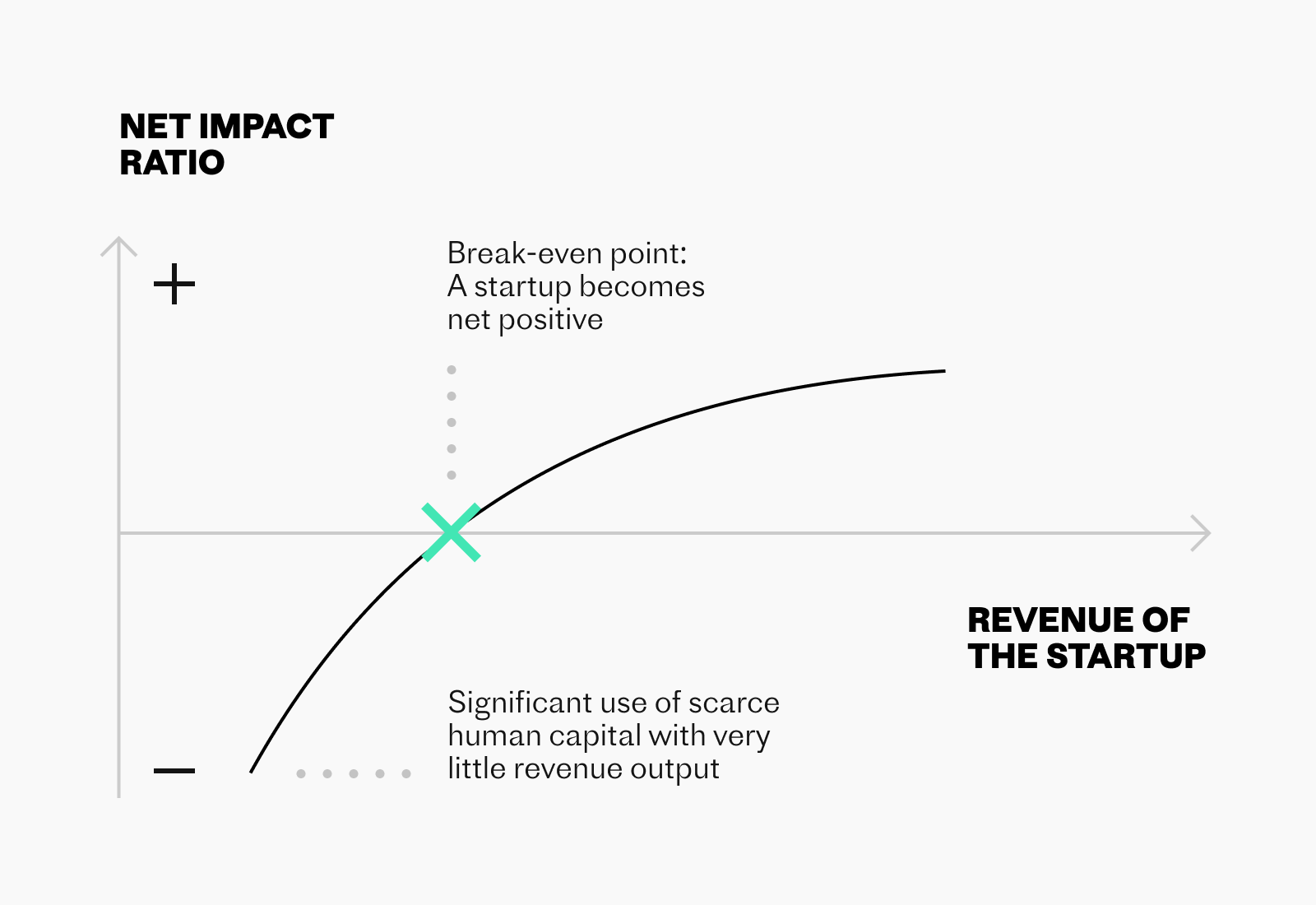

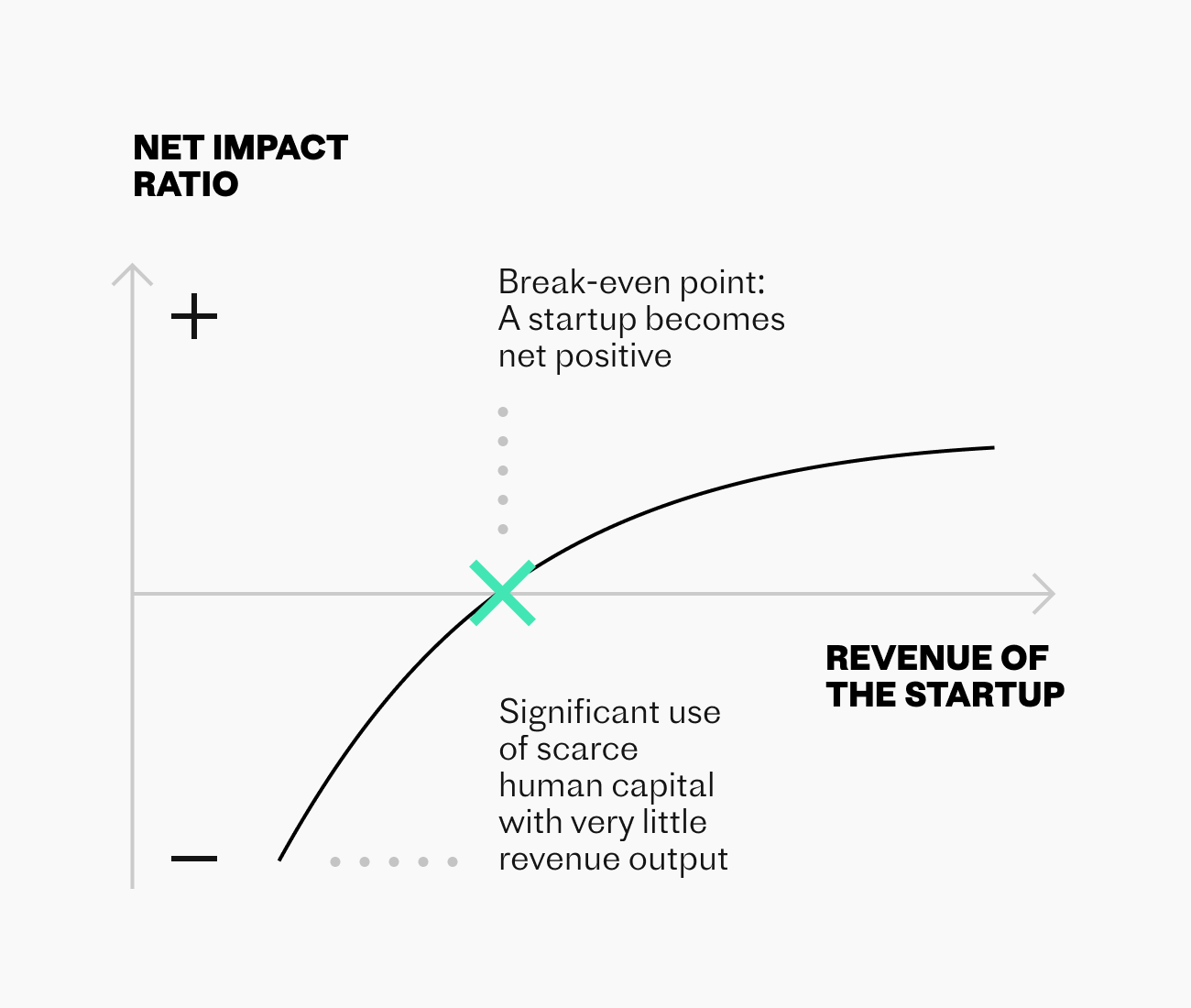

What about turning the question around: why is the majority of VC money directed towards impact-wise relatively low-ambition projects? Is it because impact-driven teams don’t know how to make money? Or because VCs still struggle to spot the projects in which EBIT and impact go hand in hand? Figure 4.5 shows the 30+30 companies’ net impact ratio plotted against their total equity funding received since founding.

Scarce human capital is a resource too

Scarce human capital, similar to any other resource, comes with an opportunity cost. Typically, startup companies use significant amounts of highly educated human capital relative to their size and realized impact. This is a natural evolution phase, and the cure is simple: growth. In terms of impact, startup companies must grow not only to break-even financially, but also in terms of net value creation.

In this group of analysed growth companies from Europe and the US, many seem to have already exceeded the “break-even point”. Nevertheless, they still create more jobs and use more scarce human capital per created revenue compared to more established companies. Figure 4.7 shows how the group of best funded US growth companies perform compared to larger US Fortune 500 companies. As can be seen, the use of scarce human capital and creation of jobs are highlighted in the growth companies group.

However, startups don’t automatically break even impact-wise even if they manage to grow - it all depends on whether their products or services are net positive in the first place. It would seem that some of the companies analysed here may also have a hard time justifying the use of their human capital in terms of the positive impacts achieved.

One example is the electronic cigarettes manufacturer Juul (Figure 4.8). While electronic cigarettes may have their upsides compared to regular cigarettes, their overall impact on health is still negative.