Chapter 1Introduction

You are reading the first-ever issue of Net Impact Report, a publication dedicated to the net value creation of companies. This report makes impact data of selected funds and companies freely available for asset owners, employees, media, investors, business leaders and anyone interested.

Why this report?

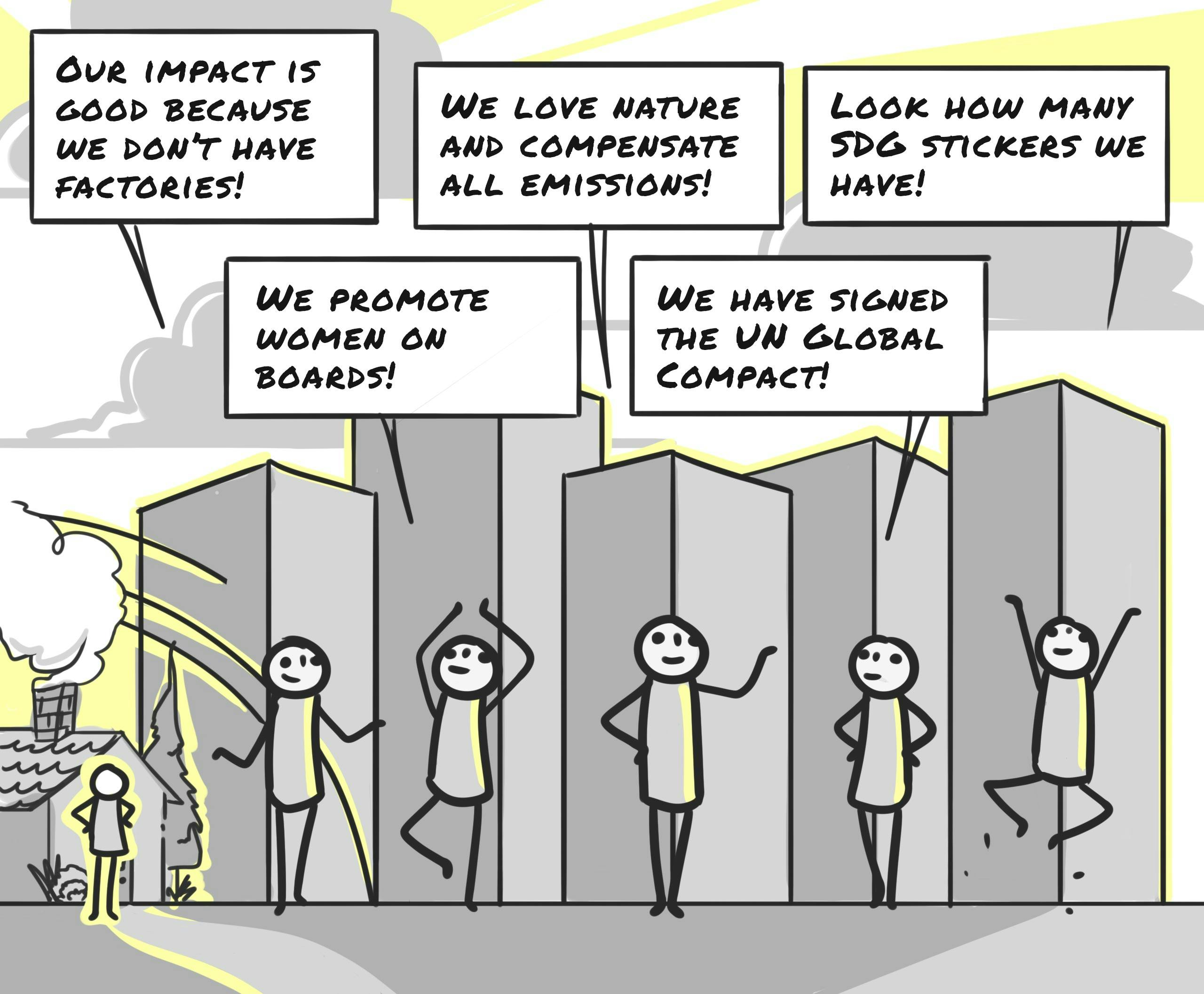

The time has come to update our ways of understanding how companies create value. We understand financials, yes. We have various types of badges and ratings for “sustainability”. We have initiatives for more women on the boards, promoting circular economy, and including colourful SDG stickers in annual reports.

But we don’t really understand the net sum of resources companies use and outcomes they achieve.

And we need to. Why? Because our current metrics for understanding where and how value is created have become outdated. At the same time, we face real global challenges we need to address together, and our natural, monetary and human resources to solve them are not infinite.

That’s why we need to not just understand and critically evaluate how companies do what they do, but also what they do in the first place. What our scarce resources are used for and what is achieved with them.

We need to be brave enough to let go of old conceptions of “good business”. Causing a little less emissions while doing something of secondary importance does not make the activity net positive.

Causing a little less emissions while doing something of secondary importance does not make the activity net positive.

How will impact rankings change in the coming years

Up until now, impact data has mainly been available for those who work hard to get it. And even after that hard work, most of the data is not comparable with other data points and ends up mainly being anecdotal.

We are on a mission to change that. In the future, companies’ net impact ratings are available, whether the company has requested one or not. Stakeholders who ultimately dictate how money moves in the world - employees, investors, clients, media, consumers - can use this data to make more fact-based decisions.

Data is comparable not just between companies and funds, but between industries too. Industry-specific beauty pageants, ranking companies within one industry, have fooled us too long into thinking that critical evaluation of industries’ impact wasn’t necessary. That every industry has their own “sustainability/ESG kings and queens” that should be crowned.

It’s time to put an end to those pageants and study every company’s value creation on equal terms. That prettiest house on the bad street may not be worth your investment, talent, cash or time at all.

That prettiest house on the bad street may not be worth your investment, talent, cash or time at all.

This report is not (just) for your sustainability manager

The responsibility for a company’s net impact lies in the same hands as decision-making power for its strategy. Typically with its owners and top management. This is not about choosing a slightly less polluting material for your product. This is about defining how your company creates value and how you argue its relevance to your most important stakeholders without whom you cannot operate: clients, investors, employees, top management.

One of our main goals is to bring the business perspective and the “sustainability perspective” together. Profit cannot be made if clients, investors and top talent no longer buy the basic mechanism through which you create value.

This is not about choosing a slightly less polluting material for your product. This is about defining how your company creates value and how you argue its relevance to your most important stakeholders without whom you cannot operate.

Impact data in the 2020's

Let’s be frank: the impact data generally available today is not great. It is no wonder it’s not really used more widely in measuring and forecasting company performance. It is lacking in robustness, relevance and comparability. Most of all: it often answers a secondary question.

Our data is not perfect either. It is still just plain wrong here and there. But it builds a uniquely holistic simulation of the big picture and with it, answers a question that matters. A question that is relevant for any business owner or manager who wants their business to still exist in five years. Relevant regardless of what you personally believe in.

How should we allocate our scarce resources to maximize the likelihood of survival and a thriving future for humanity?

Our choice is to compromise the answer rather than the question. We believe this question is the most important one to address in 2020s business value creation discussion. When reading this report I hope you pay attention to that one question above all others.

Free data, more comparison, more rigour

For way too long, impact ratings have lived inside a black box, one you have to pay to enter and even that doesn’t always help. In the absence of large-scale accessible datasets, perception of companies’ impact has been driven by marketing slogans, anecdotal data and individual PR crises dragged across media headlines.

That era ends today. It is up to data producers like ourselves to challenge our operating models enough to be able to make impact data open for public access and scrutiny. To accelerate the shift we need, all datasets published in this report are given out for free for non-commercial use for i.a. academia, journalism and other research initiatives.

More to come

This 2021 edition is the first Net Impact Report. Every year, more company and fund groups will be added to the dataset. We start off with the 500 largest companies in the world, best funded startups in the US and Europe, top 10 companies in 12 OECD countries and a selection of equity funds by global asset managers.

For future editions, asset owners, employees, academics, media and everyman alike can vote for what data they want to see next. Go have your say! Let’s jointly step up the productive and fact-based discussion on the net value creation of companies.

Editor-in-chief, Net Impact Report 2021 & Founder, Upright

What is net impact and why does it matter

A company’s net impact is the net sum of the negative and positive impacts a company has on the surrounding world.

How does it differ from other impact or sustainability metrics?

Most metrics available today are concentrated on describing how well a company does what it does. Many aim at answering questions like “How well does a company comply with a set of standards and ways of working?” or “How does a company’s sustainability practices rank among peers in the same industry?”. Supporting activities, such as reporting and governance practices, often gain a lot of emphasis.

Net impact concentrates on the scientifically-examined largest impacts a company’s core business has on the surrounding world. It answers the question: “What does the company achieve with the resources it employs? How effectively does it turn its resources into desired outcomes?"

In measuring net impact, it is crucial to model all the value chains relations from primary production to an end user, regardless of the position of the company in that value chain. For example, Apple’s net impact does not only consist of its own nice minimalistic facilities where beautiful gadgets are put together, but since the company’s products use a variety of different metals and minerals, a small fraction of the mining industry’s negative environmental impacts needs to be allocated to Apple.

Isn’t that super difficult?

Yes. But since it’s one of the most relevant questions to ask in 2020s global business, it’s difficult is not a good excuse for not trying to estimate it at all.

Upright’s pragmatic approach is: as soon as we can produce answers that address the question better than other information on which decision-making is based on today, we have an obligation to share it. Even if it’s still imperfect, work in progress and not totally polished. That causes us a bit of psychological pain and just plain embarrassment at times, but we try to handle it.

How exactly is it measured then?

To understand how the model works, read Chapter 2.1.

Why does a technology company work on something like this?

To understand why we do this, read about Upright’s mission.

The Upright Project is super ambitious as it should be, given the high stakes for world welfare. Even within the economics and business communities, it is being recognized that key social objectives have to become part of what guides firms. The challenge is to compare traditional monetary measures of welfare with non-monetary measures that are not captured by traditional accounting.

The Upright Project is taking on this task with the help of new AI technology, which has the capacity to make much more powerful inferences and suggest new value metrics compared with traditional statistical methods.

When I first heard about the Upright Project, it was like sunshine after a rainy season. I very much respected the perfect marriage of their uncompromising scientific approach with a genuine desire to help humankind to solve some of the existential challenges we face.

Upright is not just a tool for investors, it is very much something management teams have lacked. It enables competing companies to compare themselves not only based on their historical financial results, but also on their overall net impact. I also expect boards of directors to start paying more attention to the net impact of their business in the way they monitor and set objectives.

Who is in this research consortium

Since January 2020, Upright has been running a research consortium for 120+ companies and professional investors who want to be frontrunners in measuring and tracking their own net impact. The work done with the participants has helped in the production of this report, and Upright wants to thank the participants.